|

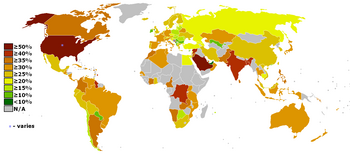

| English: Tax rates around the world: Corporate tax rates (the highest rate) by countries Polski: Stawki podatkowe na świecie: CIT (najwyższa stawka) w poszczególnych państwach (Photo credit: Wikipedia) |

Many believe the current Corporate Tax Rate in the USA is exceedingly high. Some feel a lower corporation tax reduction will encourage investment and have a positive impact on the country's financial future. The current rate stands at 39.1%, the highest rate throughout the industrial world.

Proponents feel the high rate of taxation is placing U.S. companies at a disadvantage because they cannot be as competitive as they would wish. However, is there more to add to the story?

U.S. companies pay a high corporate tax rate, but some firms have mastered the art of tax avoidance. Government records state that the total amount of corporation taxes collected has fallen in the last few years. In fact, the ratio of corporation tax to total pre-taxation profit earned is now at a historical low. A recent report carried out by the Citizens tax for Justice uncovered some shocking revelations.

The Federal Corporate Tax Rate is 35%, but 288 highly-profitable business concerns ended up paying a 19.4% rate of tax for the last five years. Boeing, Priceline, Verizon and General Electric paid no federal taxes during that period. So, how do so many companies avoid paying corporation tax?

No comments:

Post a Comment